Summary

- The Reserve Bank of Australia (RBA) Board met on 7 February 2017 and as widely expected, left the official cash rate on hold at 1.5%. There has been no change in the official cash rate since August 2016.

- The S&P/ASX 200 Accumulation Index rose by 2.3% during February, with strong gains in the first half of the month and then tailing off towards the end.

- Most Australian listed companies announced their operating results for the six months to 31 December 2016. These results were the dominant driver of market sentiment during the month. On the whole it was a positive earnings season, with many companies reporting reasonable revenue growth, an ongoing focus on cost control and capital management initiatives.

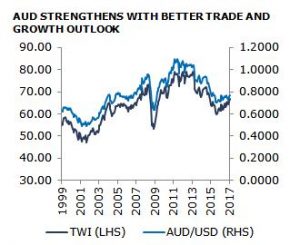

- The Australian dollar was stronger due to commodity prices over the month. The AUD ended the month up 0.9% against the USD at $US0.7656, climbing steadily over the month. Gains came despite rising expectations for an interest rate hike by the US Federal Reserve in coming months.

- Commodity prices were mixed over February, as oil stabilised and an improving outlook for China drove some commodities higher.

- News flow in February continued to be dominated by two key themes in the US: the expected policy decisions and legislative timetable of President Trump, and the timing of the next move higher in interest rates by the US Federal Reserve.

AustraliaThe Reserve Bank of Australia (RBA) Board met on 7 February 2017 and as widely expected, left the official cash rate on hold at 1.5%. There has been no change in the official cash rate since August 2016. In leaving the cash rate on hold, the RBA noted “that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.” The RBA remains upbeat about the domestic economic outlook, expecting GDP growth to return to 3% at the end of 2017, as released in the February edition of the Statement on Monetary Policy. The RBA did however downgrade near-term growth after the disappointing Q3 16 GDP figures. The RBA now expects GDP growth of 1.5-2.5% in June 2017 and 2.5-3.5% in December 2017. In terms of the outlook for the official cash rate, it is expected to remain on hold throughout 2017, as the RBA balances the risks between below-target inflation and concerns around the housing market and financial stability. Q4 16 GDP was released 1 March with growth recorded at a stronger-than-expected 1.1% per quarter, more than offsetting the -0.5% per quarter decline recorded in Q3 16. As a result, the annual growth rate rose to 2.4% per year from a revised 1.9% per year in Q3 16. The major contributors to growth in Q4 16 were: household final consumption (+0.5%pts), public investment (+0.3%pts) and net exports (+0.2%pts). Dwelling investment and commercial building investment both added 0.1%pts to growth. The largest drag on growth came from inventories (-0.2%pts). The December quarter Current Account Deficit was the lowest since 1980, recorded at -$A3.9bn and 0.9% of GDP. Higher commodity prices, particularly iron ore and coal, led to the result, with expectations high for a surplus in Q1 17. The January labour market report showed the unemployment rate fall marginally to 5.7% from 5.8%, driven by a large increase in part-time employment of 58.3k, partially offset by a fall in full-time employment of 44.8k. Wages data released for Q4 16 was in-line with expectations, with growth of 0.5% per quarter and 1.9% per year recorded, holding at a record 18-year low. |

United StatesNews flow in February continued to be dominated by two key themes in the US: the expected policy decisions and legislative timetable of President Trump, and the timing of the next move higher in interest rates by the US Federal Reserve. The market awaited most of the month for President Trump’s State of the Union address on 28 February to gain details of his plans on tax reform, particularly corporate tax rate changes and the possible introduction of a Border Adjustment Tax. This State of the Union speech failed to include any specific details longed for by financial markets. Instead, the speech revived campaign themes: replacement of Obamacare, a tax overhaul including lower corporate taxes and cuts for the middle class, $US1 trillion infrastructure investment and a sharp increase in defense spending. At the first meeting for 2017 on 2 February 2017, the US Federal Reserve Open Market Committee (FOMC) left the official federal funds target rate unchanged at 0.5-0.75% – the rate set in December 2016. Chair Yellen in her semi-annual testimony to Congress testified that the Federal Reserve Board expected “the evolution of the economy to warrant further gradual increases in the federal funds rate to achieve and maintain its employment and inflation objectives” and continued to note that “waiting too long to remove accommodation would be unwise” and require sharp increases in rates to catch up. As a result, Chair Yellen noted “at upcoming meetings, the Committee will evaluate whether employment and inflation are continuing to evolve in line with these expectations, in which case a further adjustment of the federal funds rate would likely be appropriate”. At the end of February, a 52% chance of a hike was priced in for the month of March – compared to just 31% a month earlier. As at 3 March, the chance of a hike rose to 90%. Employment was stronger than expected in January, increasing by 227k (from a revised 157k in December). The unemployment rate increased to 4.8% (from 4.7%). Retail sales continued to show good growth, rising 0.4% per month in January, following a revised 1.0% per month gain in December. Consumer confidence, as measured by the conference board survey, continued its strength post-election bounce, rising to 114.8, higher than the pre-election reading of 100.8, and the highest since 2001. |

EuropeThe European Central Bank (ECB) did not meet in February 2017. In politics the focus remained on the French Presidential elections, with polling over the month indicating a tightening race between Marine Le Pen and the centrist candidate Emmanuel Macron. Currently Marine Le Pen is polling at 27%, leading in the first round polls, with Macron at 24% and Fillon at 21%. At this stage, Macron is expected to win in the second round on 7 May 2017. In economic news, the market Eurozone Composite Index rose to 56 in February, up from 54.4 in January. This is the highest level since April 2011, and points to continued upward momentum in the economy despite the political uncertainty. |

ChinaEconomic news in China over the month focussed on continued signs of growing inflation pressures in the economy. Producer Price Inflation (PPI) was recorded at 6.9% per year for January 2017, up from 5.5% per year in December and from In early February, the People’s bank of China raised short-term repo rates and other non-benchmark interest rates. This was partly driven by higher offshore yields pressure on the RMB as well as continued credit growth in the economy. |

NZThe Reserve Bank of New Zealand met on 9 February 2017 and left the official cash rate on hold at 1.75%, where it has been since November 2016. The RBNZ continued to note that the New Zealand dollar is too high “a decline in the exchange rate is needed” and the “exchange rate remains higher than is sustainable for balanced growth and, together with low global inflation, continues to generate negative inflation in the tradables sector.” As a result, it is expected that the cash rate will remain on hold at accommodative levels for a considerable period. JapanThe Bank of Japan did not meet in February. Its next meeting will be held on 16 March 2017. The preliminary Q4 16 GDP data was released, indicating growth of 0.2% per quarter and 1.7% per year. Tthis was up from 1.1% per year in Q3 16. Growth was led by solid exports and improved capital expenditure. |

United KingdonThe Bank of England (BoE) met on 1 February 2017 and as widely expected held policy unchanged. The BoE also released its quarterly Inflation Report, with the Monetary Policy Committee increasing its central expectation for growth to 2.0% in 2017, and expects growth of 1.6% in 2018 and 1.7% in 2019. The improved outlook reflects additional fiscal stimulus, improved global growth, higher equity prices and more supportive credit conditions for households. There were reports over the month that the government will implement corporate tax cuts to mitigate the impact of Brexit, particularly if a new deal with the European Union is not reached. The UK corporate tax rate is already on the competitive side at 20%, therefore the tax rate would have to fall below 17% to increase its competitive future. Economic data released over the month showed a continued uptrend in inflation, with the annual rate for January rising to 1.8% per year, from 1.6% per year. Expectations remain that inflation will continue to rise. This was compounded by announcements from major utility companies of large price increases in 2017, upward of 7%. |

|

|

Australian dollar

|

Source: Bloomberg as at 28 February 2017 |

Commodities

|

Source: Bloomberg as at 28 February 2017 |

Global sharesGlobal developed equity markets continued to perform over February with better economic data and the expectation of tax and regulatory reform. The MSCI World Index was up 2.6% in US dollar terms in the month of February and 1.1% in Australian dollar terms. In the US, the S&P500 (3.7%), the Dow Jones (4.8%) and the NASDAQ (+3.8%) were all stronger, with all three making new all-time highs and the Dow Jones crossing 21,000 just after month end following Trump’s speech. On a sector basis, MSCI Health Care (+5.6%), Information Technology (+4.5%) and Consumer Staples (+4.2%) were the best performers. MSCI Energy (-2.6%), Materials (-0.9%) and telecommunications (-0.0%) lagged behind. Equity markets in Europe also moved higher with the stronger economic outlook, despite rising political risks. The large cap Euro Stoxx 50 Index rose +2.8%. The best performing major EU market was the Netherlands (+3.9%), while Germany (+2.6%), Spain (+2.6%), France (+2.3%) and Italy (+1.7%), and rose. The UK FT100 was also stronger up +2.3% in February. Asia markets eked out smaller gains, with the Japanese Nikkei 225 up +0.4% as the Yen depreciated 0.2% against the USD. The other major markets performed a bit better over the month with Hong Kong (+1.6%), Singapore (+1.6%), Korea (+1.2%) and Taiwan (+3.2%) all making gains. |

Source: Bloomberg as at 28 February 2017 |

Australian sharesThe S&P/ASX 200 Accumulation Index rose by 2.3% during February, with strong gains in the first half of the month and then tailing off towards the end. Most Australian listed companies announced their operating results for the six months to 31 December 2016. These results were the dominant driver of market sentiment during the month. On the whole it was a positive earnings season, with many companies reporting reasonable revenue growth, an ongoing focus on cost control and capital management initiatives. Consumer Staples was the standout sector during the month, driven by a number of better-than-expected results, including from sector leaders Wesfarmers and Woolworths. REITs performed well, supported by a small decline in bond yields. It was also a positive month for Financials, which were underpinned by solid trading updates from the ‘big four’ banks. The large banks reported better-than-expected bad and doubtful debt, slightly stronger mortgage repricing and solid cost control. Health Care had another strong month, with Mayne Pharma and Sirtex posting double-digit gains. Large bio-tech company CSL also outperformed on solid revenue growth. Lagging the broader market were Materials, Telco and Energy. Materials were lower despite companies in the sector posting strong results and better-than-expected dividends and capital management initiatives. Telstra dragged the Telco sector lower as the company reported softer revenue trends and pressure on key segment margins. |

|

Global emerging marketsEmerging market equities continued to recover their post-election losses, with the MSCI Emerging Market Index up 3.0% in USD terms and 1.5% in AUD terms. Stability in the USD and yields along with softer rhetoric around US trade policy and a better global growth outlook supported emerging markets. MSCI EM Latin America and MSCI EM Asia ex Japan both gained 3.3% over the month. The Shanghai Composite Index was also stronger, up 2.6%. The MSCI EM Europe, Middle East and Africa (+0.1%) underperformed the broader index, dragged down by weakness in Russia (-8.2%) and Hungary (-1.3%). |

|

Global and Australian developed market fixed interestMost of the recent excitement in markets came immediately after month end with President Trump’s highly anticipated address to Congress and comments from the US Federal Reserve Open Market Committee (FOMC) impacting markets on 1 March. The previous “risk-on” sentiment was reversed over the month as markets remain cautious to the potential for further drastic immigration and trade reform. Overall, this resulted in 10-year government bond yields falling modestly through the month. Falls in Europe and the UK were the largest, as political unrest and uncertainty continued to weigh on sentiment. Bond yields in the UK and Europe moved the most in the month with 10-year gilts down 27 bps and German bunds down 23 bps. In the US, 10-year yields fell 6 bps and Japanese bonds fell 3 bps. Australian yields were range bound in the month and closed out not far from where they opened the month, with the 10-year yield up 1 bp to 2.72%. Short-dated yields fell more, resulting in a flattening of the curve. Rates at the long end were likely impacted by the large Australian Government Bond issuance distracting markets from falling further with the US. |

|

Global creditCredit spreads continue to be largely resilient to the Trump factor, though we note that the majority of headlines have not been economic in nature. The anticipated announcement of his tax policies (when the details are finally released) have potential to move credit spreads, especially if the nature or timing around tax changes disappoint. European political event risk remains a potential headwind for credit spreads however credit is again proving resilient so far. Following significant issuance in January, investment grade credit continued to provide opportunity for investors with sustained robust supply in the month. Specifically, the Bloomberg Barclays Global Aggregate Corporate Index average spread moved 4 bps narrower to 1.19%. US credit moved 6 bps narrower, with the Bloomberg Barclays US Aggregate Corporate Index average spread down to 1.10%. In Europe, the spread on the Bloomberg Barclays European Aggregate Corporate Index was 4 bps wider to 1.24%. US high yield credit spreads continued to narrow in the month but in a much tighter range. The spread on the Bank of America Merrill Lynch Global High Yield index (BB-B) narrowed by 19 bps to 2.99%. The high yield market continues to be impacted by downgrades particularly in the energy and mining sectors. Australian credit spreads moved tighter in the month with the average spread on the Bloomberg Australian Corporate Index 7 bps tighter to 117. Supply continues to be limited in contrast to demand but Australian credit largely remains buoyed by a supportive technical environment. |

|

Listed propertyThe S&P ASX 200 A-REIT index increased 4.1% in February in AUD terms, against a backdrop of stabilising bond yields and well-received half year earnings results. The best performing A-REITs included Charter Hall Group (+11.9%) and Goodman Group (+9.1%). Property management company Charter Hall Group gained on the announcement of strong earnings numbers, driven by higher transaction and performance fees, and robust growth in both investment management revenue and property income. The worst performing A-REIT was BWP Trust (-2.4%). Reasonable earnings numbers were overshadowed by lingering concerns that vacancy rates would rise at its commercial property portfolio in coming years as core tenant Bunnings departs several properties. Listed property markets offshore also gained ground in February. The FTSE EPRA/NAREIT Developed Index (TR) increased by 3.2% in US dollar terms. Australia was the best performing country. Japan and Continental Europe lagged but still generated positive returns during the month. DISCLAIMER This website contains general advice which does not consider your particular circumstances. You should seek advice from Wealth & Retirement Solutions who can consider if the general advice is right for you. You should also consider the Product Disclosure Statement before making any investment or product decisions. This website contains past performance information. Past performance is not always a reliable indicator of future performance and you should not rely solely on it to make investment decisions. |

|

|

This document has been prepared by Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) based on its understanding of current regulatory requirements and laws as at 3 March 2017. Colonial First State is the issuer of the FirstChoice range of super and pension products from the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557. Colonial First State also issues interests in products made available under FirstChoice Investments and FirstChoice Wholesale Investments, other than FirstRate Saver, FirstRate Term Deposits and FirstRate Investment Deposits which are products of the Commonwealth Bank of Australia ABN 48 123 123 124, AFS Licence 234945 (the Bank). Colonial First State is a wholly owned subsidiary of the Bank. The Bank and its subsidiaries do not guarantee the performance of FirstChoice products or the repayment of capital for your investment. This document may include general advice but does not take into account your individual objectives, financial situation or needs. You should read the relevant Product Disclosure Statement (PDS) carefully and assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision. PDSs for Colonial First State’s products are available at colonialfirststate.com.au or by calling us on 13 13 36. © Colonial First State Investments Limited 2017DISCLAIMER |

|