Summary

- The Reserve Bank of Australia Board did not meet in January 2017. We currently expect the RBA to maintain interest rates at 1.5% for the duration of 2017.

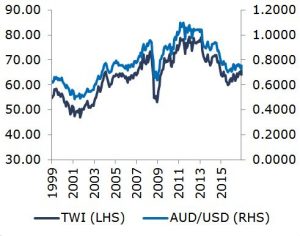

- The Australian dollar was stronger off the back of commodity prices over the month. The AUD ended the month up 5.02% against the USD at $US0.7570.

- The S&P/ASX 200 Accumulation Index finished January 0.8% lower, following two months of steady gains. Weakness in Real Estate (-4.8%) and Consumer Discretionary (-4.3%) were the main drags on market performance.

- The biggest event for global financial markets in January – and potentially the biggest event for the year, was the inauguration of Donald Trump as the 45th President of the United States on 20 January.

- The next major political event will be President Trump’s speech to a joint sitting of congress scheduled for 28 February, which is traditionally used by new Presidents to lay out policy priorities for the years ahead. We expect further details of Trump’s legislative agenda from this speech.

- At the first meeting for 2017, the US Federal Reserve Open Market Committee left the official Fed Funds target rate unchanged at 0.5%-0.75% – the rate set in December 2016.

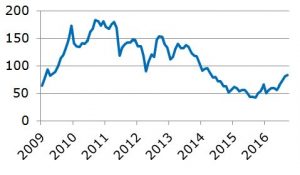

- Most commodity prices remained well supported in January, as the OPEC supply cuts began to take effect. The market continues to price in expectations of rising infrastructure spending.

AustraliaAs per usual, the Reserve Bank of Australia (RBA) Board did not meet in January 2017. The next meeting will be on 7 February 2017. We currently expect the RBA to maintain interest rates at 1.5% for the duration of 2017. The big data point for January was the release of Q4 16 Consumer Price Inflation (CPI) which came in below consensus estimates. Headline CPI rose 0.5% per quarter and 1.5% per year, from 1.3% per year in Q3. Key drivers included increases in Tobacco (+7.4% per quarter) and automotive fuel (+6.7% per quarter). This was partly offset by falls in furnishings, household equipment and services (-0.8% per quarter) and communication (-0.8% per quarter). Price falls for clothing and accessories (-0.8% per quarter) and household equipment are likely related to the heavy discounting over the fourth quarter and the early start to Christmas sales. Underlying inflation, the RBA’s preferred measure, rose to 0.4% per quarter, while the annualised rate rose slightly to 1.5% per year from 1.3%. Both measures of inflation are still below the RBA’s 2-3% target band, however they are also in line with the RBA’s own forecasts of inflation so are unlikely to lead to any change in policy or outlook. The December labour market report showed the unemployment rate up marginally at 5.8 %, from 5.7%, but with total employment up 13.5k (+9.3k full-time, +4.2k part-time). The increase in the unemployment rate was driven by a 0.1% pick-up in the participation rate to 64.7%. The NAB business survey for December showed a recovery in business conditions which had weakened during 2016. Conditions rose from +6 to +11, driven by a pick-up in trading and profitability, likely related to the December holiday period, the recovery in conditions, if sustained, suggests a stronger outlook for economic growth going forward. Business confidence was stable at +6, in line with the long term average. The December terms of trade data showed an all-time record surplus of $AU3.5bn, significantly above the $AU2bn expected and a strong increase from November’s revised $AU2bn. The increase was led by a 5% increase in exports, driven largely by increasing prices for coal and iron ore over the month. ChinaActivity data in China showed a pick-up in growth in Q4 16. GDP increased to 6.8% per year from 6.7% previously, well within the 6.5%-7% target for 2016. The growth target for 2017 has been announced at 6.5% per year. Other economic data over the month showed further stabilisation in the economy. Industrial Production decreased to 6.0% per year (from 6.2% per year previously). Retail Sales were up +10.9% per year (from 10.8%) and Fixed Asset investment fell +8.1% per year (from 8.3%). Inflation remained moderate in December, decreasing to 2.1% per year from 2.3%. China’s PPI increased by a very solid 5.5% per year in December, well up from 3.3% in November, and the highest level since September 2011. |

United StatesThe biggest event for global financial markets in January – and potentially the biggest event for the year, was the inauguration of Donald Trump as the 45th President of the United States on 20 January. Trump’s inauguration speech repeated much of the tone and content of his campaign and sent a clear message that from now it would be “America First” and a call to “buy American [and] hire American”. While financial markets continued to react largely positively to President Trump for most of the month, his protectionist and anti-immigration rhetoric and policies began to weigh on markets towards month end. The next major political event will be President Trump’s speech to a joint sitting of congress scheduled for 28 February, which is traditionally used by new Presidents to lay out policy priorities for the years ahead. We expect further details of Trump’s legislative agenda from this speech. At the first meeting for 2017, the US Federal Reserve Open Market Committee (FOMC) left the official Fed Funds target rate unchanged at 0.5%-0.75% – the rate set in December 2016. This decision was widely expected by the market (and us) – and is consistent with the Fed waiting to see the size and shape of any potential fiscal policy easing from President Trump and more data on the economy before considering further monetary policy action. In detailing the policy decision, the Fed statement was a little more upbeat on the economy, but not hawkish enough to convince the markets (or us) that a rate hike at the next FOMC meeting in mid-March was likely. The commentary is consistent with a slightly better outlook for the US economy in 2017 and consistent with the Fed achieving its dual-mandate of full-employment and price stability. As a result, the Fed continues to signal that further “gradual increases in the federal funds rate” should be expected this year. Q4 2016 GDP released during the month showed growth a little weaker than expected at +1.9% per quarter seasonally adjusted and annualised, comparted to expectations of +2.2% per quarter. Annual growth for 2016 came in at 1.9% per year, up from 1.7% in Q3 16. Employment was a little weaker than expected in December, increasing by 156k (from a revised 204k in December). The unemployment rate increased to 4.7% (from 4.6%). However, average hourly earnings increased +0.4% per month, taking the annual rate up to 2.9% per year a new cycle high. Inflation continued to increase at a moderate pace with headline CPI up 0.3% per month in December, and the annual rate increasing to 2.1% per year (from 1.7%). The core CPI increased by 0.2% per month, with the annual rate up to 2.2% per year. The Fed’s preferred measure of underlying inflation, the core Personal Consumption Expenditure (PCE), edged up to 1.7% per year in December, from 1.6% previously. |

EuropeThe European Central Bank (ECB) met on 19 January 2017 and left monetary policy unchanged. The next meeting is scheduled for 9 March 2017. EU growth remained robust in Q4 16, coming in at +0.5% per quarter, with the annual rate increasing to 1.8% per year, well above estimated potential growth of 1% per year. At the country level, Spain continues to lead the block, growing at 2.8% per quarter, while French growth has improved to 1.7% per quarter and German growth is expected at 2% per quarter. The EU unemployment rate continues to decline, falling from 9.7% to 9.6% in December, the lowest rate since mid-2009. The first estimate of January Eurozone CPI showed inflation increased to 1.8% per year from 1.1% per year previously. The increase was largely driven by a jump in energy prices which were up 2.5% per month. In politics the focus is turning to the French Presidential elections, with the Socialist Party nominating Benoit Hamon as their candidate over the month. Current polling suggests Marine Le Pen is likely the make it through the first round (23 April 2017) and face either The Republican candidate Francois Fillon or centrist candidate Emmanuel Macron in the second round run-off (7 May 2017). |

United KingdonThe Bank of England (BoE) did not meet over January. The next meeting will be 2 February 2017. The annual rate of inflation rose to 1.6% per year in December (from 1.2%), with the core CPI up 1.6% per year in November (from 1.4%). Inflation continues to be driven by the weaker Pound and higher energy prices, but the larger than expected increase in December was also related to high seasonal volatility in airfares. Q4 16 GDP came in at 0.6% per quarter, keeping the annual rate at 2.2% per year, in line with the BoE’s revised forecasts and significantly above pre-Brexit expectations. Services remain the driver of growth with manufacturing and construction both declining over the quarter. Over the month Prime Minister Theresa May offered more insight into what the eventual exit will look like. At her highly anticipated 17 January speech, she confirmed that the UK will take back control of immigration and will leave the single market but is hopeful that a free trade agreement can be reached with the EU. She was also adamant that the UK will no longer be beholden to the decisions of the European Court of Justice and pledged to give both houses of Parliament a vote on the final deal. |

NZNZ Prime Minister Bill English called elections for 23 September following the shock resignation of PM Key last month. Q4 16 CPI out in January was stronger than the 0.3% per quarter expected at 0.4% per quarter, the annual rate increased to 1.3% per year. Inflation is now back within the RBNZ’s 1-3% target band for the first time since Q3 14. |

JapanThe Bank of Japan (BoJ) held the cash rate steady at -0.1% in January and the 10yr JGB target rate at 0.0%. The annual rate of headline inflation fell from 0.4% to 0.3% per year in December, with the core pace of inflation also down marginally to 0.0% per year from 0.1% previously. |

Australian dollar

|

Source: Bloomberg as at 31 January 2017 |

Commodities

|

Source: Bloomberg as at 31 January 2017 |

Australian sharesThe S&P/ASX 200 Accumulation Index finished January 0.8% lower, following two months of steady gains. Weakness in Real Estate (-4.8%) and Consumer Discretionary (-4.3%) were the main drags on market performance. Real Estate gave back some of December’s outperformance in the lead up to going ex-dividend. Consumer Discretionary fell as a number of retail stocks, including Myer (-12.3%), reversed last month’s seasonal gains. The Industrials sector (-4.7%) was led lower by global pallet company Brambles (-16.1%), which fell sharply after posting a significant guidance downgrade. Energy (+0.5%) edged higher, as a number of companies in the sector posted their quarterly production and revenue results, which were broadly in line with expectations. Materials (+4.7%) had another strong month, led higher primarily by strength in commodity producers such as BlueScope Steel and Fortescue Metals. Most precious and industrial metals finished the month higher, while iron ore reached two-year highs. Health Care (+4.8%) had a better month, led higher by sector giant CSL. The company posted double-digit gains after issuing a surprise FY2017 profit upgrade. Elsewhere in the sector, Sirtex Medical stemmed losses after losing almost half of its value during December. |

|

Listed propertyThe S&P ASX 200 A-REIT index gave back some of December’s gains, declining by -4.8% in January despite a lack of material stock-specific news. A-REITs are due to announce their latest quarterly earnings results in February. The best performing A-REITs included Charter Hall Retail REIT (flat) which was supported by the defensive nature of its grocery-anchored retail properties; and information storage and management company Iron Mountain (+5.4%). Underperformers included larger, relatively liquid A-REITs including Dexus Property Group (-6.7%) following strong gains during the 2016 calendar year; and GPT Group (-7.0%). Listed property markets offshore performed better, finishing the month in positive territory overall. The FTSE EPRA/NAREIT Developed Index (TR) increased by 0.6% in US dollar terms. |

|

Global sharesGlobal developed equity markets mostly consolidated their post-election gains over January, with some give-back late in the month off the back of protectionist policies announced by the Trump administration. The USD also gave back some of its recent gains with the DXY index ending the month down 2.6%. The MSCI World Index was up 2.4% in US dollar terms in the month of January and -2.4% in Australian dollar terms. In the US, the S&P500 (+1.8%), the Dow Jones (+0.5%) and the NASDAQ (+4.3%) were all stronger, with the Dow Jones reaching a new all time-high and surpassing 20,000 for the first time. On a sector basis, MSCI Materials (+6.7%), Information Technology (+4.5%) and Consumer Discretionary (+3.4%) were the best performers. MSCI Energy (-3.0%), Telecommunications (+0.2%) and Utilities (+0.6%) lagged behind the gains. Equity markets in Europe were mostly weaker over the month. The large cap Euro Stoxx 50 Index fell -1.8%. The best performing EU market was Germany (+0.5%) while Italy (-3.3%), Spain (-0.4%), France (-2.3%) and the Netherlands (-1.3%) all fell. The UK FT100 was also weaker down -0.6% in January. Asia markets were mixed, with the Japanese Nikkei 225 down -0.4% as the Yen appreciated 3.4% against the USD. However the other major markets rose over the month with Hong Kong (+6.2%), Singapore (+5.8%), Korea (+2.0%) and Taiwan (+2.1%) all making gains. EQUITY MARKETS CAUTIOUS AS THEY AWAIT POLICY GUIDANCE. |

Source: Bloomberg as at 31 January 2017 |

Global emerging marketsEmerging market equities recovered last month’s losses over January in USD terms, with the MSCI Emerging Market Index up 5.4%, outperformance against DM equities. The weaker USD, higher commodity prices and stability in yields supported emerging markets, despite the increasing concerns around US Trade policy. MSCI EM Latin America gained 7.5% over the month with strong gains In Argentina (+12.8%) and Brazil (+7.4%). The MSCI EM Europe, Middle East and Africa (+2.1%) and MSCI EM Asia ex Japan (+6.2%) were also up on the month. The Shanghai Composite Index was also stronger, up 1.8%. |

|

By Carlos Cacho, Analyst, Economic and Market Research

© Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468.

This document has been prepared by Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) based on its understanding of current regulatory requirements and laws as at 2 February 2017. This document is not advice and provides information only. It does not take into account your individual objectives, financial situation or needs. You should read the relevant Product Disclosure Statement available from the product issuer carefully and assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision.